Being trapped in a Thai night market was the unexpected starting point for a successful $4.7 million startup.

Australian Fintech Startup WAIWIN Raises $4.7 Million to Revolutionise Cross-Border Payments in Southeast Asia

In an exciting development for international travellers, Australian fintech startup WAIWIN has announced its Series A funding round, aiming to raise $4.7 million to expand its cross-border payments service across Southeast Asia.

Founded by George Lipinski and Lili Wang, WAIWIN combines technology with a community-powered network, utilising over 400 'Thai Trusted Locals' to facilitate transactions. This innovative model is set to revolutionise the way travellers interact with local payment systems, particularly in Thailand.

Thailand, consistently ranked the world's most visited city, welcomed around 37 million international visitors annually before the pandemic. However, travellers have had no access to local QR payment systems like PromptPay, relying instead on cash withdrawals and ATMs. With Kasikornbank charging foreigners 250 Baht (around A$12) per withdrawal, these fees have become a significant burden for tourists.

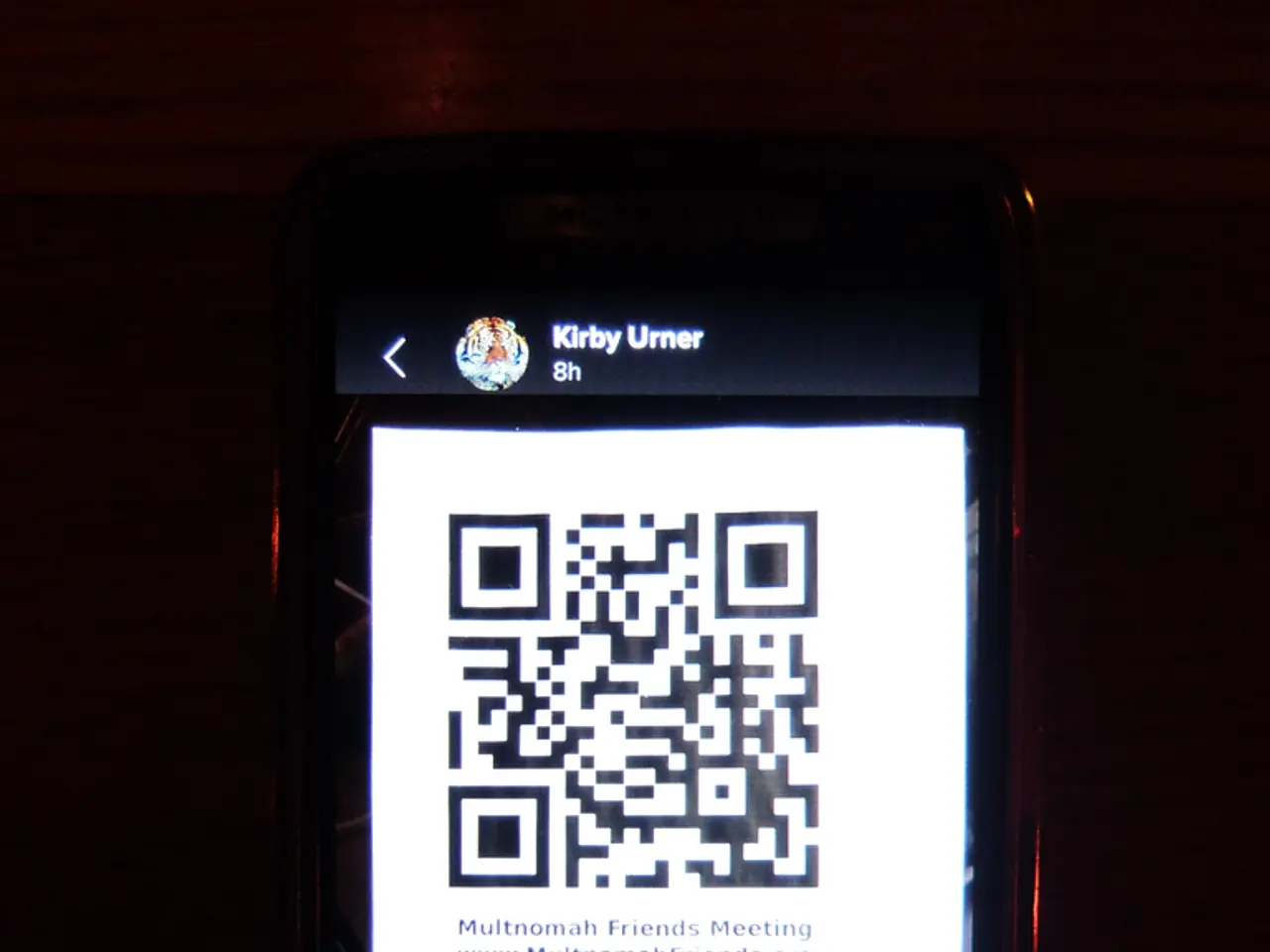

WAIWIN aims to connect international travellers directly to local QR-code payment systems, enabling them to live like locals from the moment they arrive. At checkout, travellers scan a vendor's PromptPay QR code, and the local pays the vendor using their own PromptPay account and is reimbursed through WAIWIN, earning a commission in the process.

The startup's goal is to eventually eliminate the need for travellers to carry cash altogether. This ambition is shared by Nuttapong Sirisoponsilp, the founder of WAIWIN, who aspires to make local QR payments accessible to anyone, anywhere.

The Series A raise will be used to expand engineering capacity, deepen regulatory compliance, and prepare for entry into new markets including India, Vietnam, Malaysia, the Philippines, Mongolia, and Kenya.

WAIWIN's strategic brand partnership with Thai lifestyle house Jim Thompson is another testament to the startup's commitment to integrating seamlessly into local communities.

A viral Instagram Reel by a Russian traveller describing her experience with the app generated over 800,000 views, helping to fuel adoption. WAIWIN now boasts more than 3,000 users from over 70 countries, including hundreds of Australians.

As WAIWIN continues to grow, it promises to make travel in Southeast Asia more accessible, convenient, and cashless for millions of international visitors each year.

Read also:

- Jaroslav Rudiš is organizing the Wiesbaden Literature Festival in 2025

- Top 5 ASX-Listed Graphite Companies Projected for 2025

- Affordable, Comprehensive Energy Storage Solution for Small-Scale Power Plants: The Marstek Jupiter C Plus, Priced Under 220 € per Kilowatt-Hour, Offers a 100 € Discount per Set.

- Sunscreen: Its Capabilities and Limitations - Unveiling the Facts About Its Protection and Inefficiencies